December 03, 2020 | M&A Reports

Crosbie & Company Canadian Mergers & Acquisitions Report for Q3 2020

Uneven Quarter Despite Strong Rebound in Deal Activity

In the third quarter of 2020, there were some signs of life in the Canadian M&A market with 804 announced transactions representing aggregate value of $18B.

Following a very weak second quarter when we experienced heavy disruption from COVID-19, the number of announced transactions in Q3 increased by 34%, surprising many observers by rebounding back to a level that was in line with the average for the four quarters that preceded the pandemic shutdown. Despite this rise in activity, the total value of announced deals remained quite low by historical measures. Q3 aggregate deal value was the second lowest quarterly value in the last ten years, surpassed only by last quarter when the aggregate value was $14B.

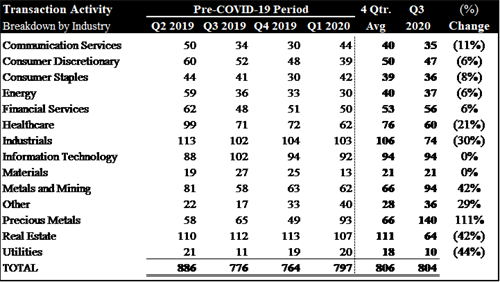

As we will discuss in more detail later in this report, the overall numbers don’t tell the whole story. Behind the strong rebound in activity, we can see the uneven impact of the COVID-19 pandemic on different sectors, with some experiencing very large increases relative to pre-COVID-19 periods and others displaying notable softness.

Similar to the last couple of quarterly M&A reports, we will depart from our usual format by providing a brief commentary on the trends we see in the broader M&A markets, including some highlights from the Q3 data. Then, following that discussion, we will provide our customary analysis for the quarter.

Similar to the previous quarter, we will provide some perspectives on what we currently see happening in the markets, as well as some thoughts on the implications for M&A activity in future quarters. Then, following that discussion, we will provide data and analysis of M&A activity in Q2/2020.

How COVID-19 is Impacting M&A

Over the past two quarters, we have been in the market with some deals of our own. But we’ve also been keeping in close contact with many M&A market participants (including PE and corporate buyers, potential sellers, advisors of different types, banks, debt funds, specialty lenders and other institutional investors) to keep tabs on what other people are seeing and experiencing. The anecdotal feedback is generally that conditions have improved and activity is up, despite a reasonable degree of ongoing “disruption”, as described below.

- Lack of Visibility – we have obviously been in a period where many businesses as well as the markets they serve have been disrupted by COVID-19, some significantly. While many of these businesses have already experienced some degree of recovery (meaningful in some cases), there is still a general question of what the new normal will look like and when they will get there. This creates uncertainty which in general is something that creates challenges for buyers and sellers alike.

- Closed Border – M&A is very international and historically cross-border transactions have represented almost half of the total deal activity. Accordingly, the fact that there is great difficulty in getting business people across the border (safely or at all) makes deal execution slower and much more complicated.

- Fewer Face-to-Face Meetings – M&A transactions are very people centric, so the difficulty in holding in-person meetings has wide-ranging consequences. These range from impacts on the advisor’s work prior to approaching buyers to the vendors gaining trust and credibility with the buyers. Lack of face-to-face interaction also makes it tougher to complete due diligence, finalize transition arrangements, and to resolve sticky problems in the negotiations. These consequences represent another headwind and result in longer timelines and more places for deals to come off the rails.

- Financing – the ease of financing and availability of capital have come a long way over the past quarter but there are still some areas of the market where financing can be challenging. Generally speaking, large companies, public companies and private equity sponsors that have been less disrupted by COVID-19 have experienced good access to capital throughout the crisis. However, it has been less easy for smaller private companies which by their nature have weaker balance sheets and less diversification. Given that about 90% of our M&A market represents “mid-market” companies, this creates a potential headwind for an important component of the overall market.

- The Pre-COVID-19 vs. Post-COVID-19 Transaction Cohorts – over the past two quarters (i.e. since the COVID-19 shutdown), most closed transactions are the result of sale processes that began before March. These “old cohort deals” had the advantage of their process starting before the new social distancing norms. However, we are now increasingly shifting into a new cohort which began after the shutdown. Aside from potential timing issues, it will be interesting to watch for differences in this new cohort.

Winners and Losers

While the above factors have cut across most industry sectors, we still see a very uneven landscape. Some companies and sectors are relatively “business as usual” and are able to pursue sell-side M&A should they desire to do so. At the other end of the spectrum are companies with highly disrupted business models that are in restructuring mode. For this group, M&A is difficult and when it is happening it tends to be distressed.

But then there is also a large group of companies in between. Many of these companies have experienced substantial rebounds in their businesses after the first wave. These companies have been largely on the sidelines so far. But among those with relatively solid rebounds, some are already in a position to entertain sale transactions again, particularly where they can demonstrate a path to stabilized, sustainable earnings.

M&A within some sectors and areas of the market have clearly had minimal or in some cases positive impacts from the effects of COVID-19. Such sectors include companies in mining, technology, food related areas, and some essential product and services companies. Additionally, certain types of companies have also been relatively unimpeded, including many public companies and larger private companies operating in markets less impacted. On the other hand, many smaller private companies have had a much harder time and are compelled to stay on the sidelines for now.

Q3 2020 M&A Highlights - Peeling the Onion - Key Themes

With 804 announcements in Q3 2020, we have overall activity that was in line with the average for the four quarters preceding the shutdown (Q2 2019 to Q1 2020). However, beneath the surface, we see that the overall numbers are being supported by large increases in certain sectors which mask weakness in many others. For example:

- The hottest sectors were precious metals (140 deals, up 111%) and metals and mining (94 deals, up 42% in Q3)

- Additionally, contained within the financial services sector, we see a large increase of reverse takeover deals, most of which involved listed shell companies (31 deals, an 8-fold increase)

- Important sectors with large declines included real estate (64 deals, down 42%), industrials (74 deals, down 30%), and utilities (10 deals, down 44%)

Overview

- Deal activity increased 34% in the third quarter of 2020 with 804 announced transactions, following a significant decline in deal activity in Q2

- Aggregate deal value was $17.5B, a 61% decline relative to Q3 2019

- Aggregate deal value is the second lowest amount in the last 10 years

- Cross-border M&A activity was strong in Q3 with 366 announced acquisitions, representing 46% of aggregate deal activity which is comparable to prior quarters

Mega-Deals

- There were only 2 mega-deals announced in the third quarter of 2020 with an aggregate value of $2.7B

- Mega deal activity has been muted in 2020 with only 12 mega-deals announced year-to-date

- The largest announced transaction this quarter was the $1.6B acquisition of waste collection services company WCA Waste Corp. by GFL Environmental Inc. (TSX:GFL)

Industry Sector Activity

- Precious Metals and Metals and Mining were two of the most active sectors this quarter with 140 and 94 announced deals, respectively

- Information Technology was also an active sector this quarter with 94 announced deals

- Real Estate remains the most impacted sector on a year-over-year basis with only 64 deals (a 43% decline relative to Q3 2019) and value of $3.6B which is down 81%)

Breakdown by Transaction Size

- 94% of transaction activity in the quarter was from mid-market transactions below $250M (for transactions with disclosed values)

- In this segment, there were 332 transactions valued at $6.1B or approximately 35% of total M&A value

- Q3 Mega-deal activity (deals over $1B) declined from Q2 of 2020, with only 2 announced transactions valued at $2.7B

Canadian Domiciled versus Foreign M&A Targets

- There were 530 acquisitions of Canadian domiciled companies in Q3, a 3% increase relative to Q3 2019

- Aggregate deal value for these Canadian domiciled targets declined 70% to $8.2B

- 274 transactions this quarter (34% of the total) were for companies domiciled outside of Canada

- Canadian companies made 608 acquisitions in the third quarter including 386 domestic deals

Cross-Border Deals

- Cross-border deals represented 46% of total activity and 65% of total deal value

- Outbound cross-border activity increased 13% and inbound cross-border activity increased by 4% compared to the same quarter in 2019

- As a percentage of total cross-border activity, Canada/US transactions represented 56% of cross-border activity and 61% of aggregate deal value

Deals by Provincial Domicile

- Ontario remains the most active province this quarter with 180 announced deals valued at $2.7B

- British Columbia was also active this quarter with 136 deals valued at $858M

- Quebec had the second largest aggregate deal value of $2.4B, comprised of 50 transactions